If you’ve ever dabbled in creating websites, you’ll know the thrill of crafting something from scratch, pouring in time and effort, and then — poof! — watching it generate passive income while you sip tea and binge watch your favourite series. For me, investing in dividend stocks feels exactly like that. It’s like building a slick website that keeps paying you long after the coding’s done. Let me share why I’m all in for dividend stocks.

The Webmaster Analogy: Building Sites, Building Wealth

Picture this: you’re a webmaster (or maybe just vibe with the idea). You spend countless hours designing a website — picking the perfect domain, tweaking its layout and optimising SEO like a mad scientist. It’s work, sure, but once it’s live, that site starts pulling in consistent ad revenue or affiliate cash without you lifting a finger.

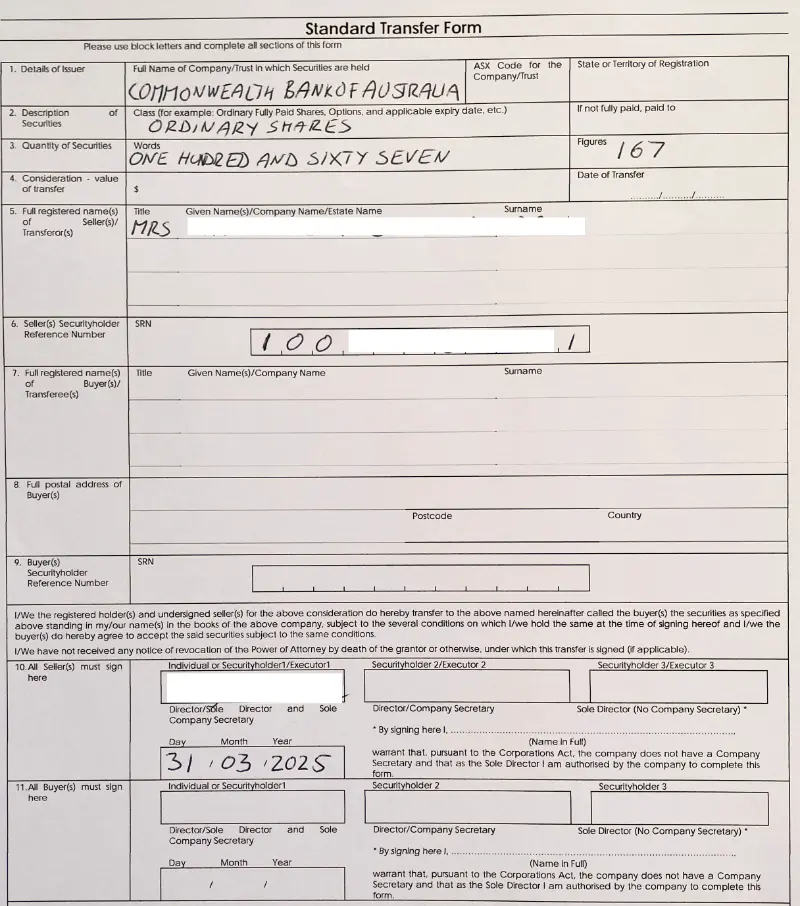

Dividend stocks? Same deal. You invest your hard-earned capital (like time spent coding), pick some solid companies (your “premium domains”), and then sit back as they funnel you regular dividend payments — your financial equivalent of passive website income.

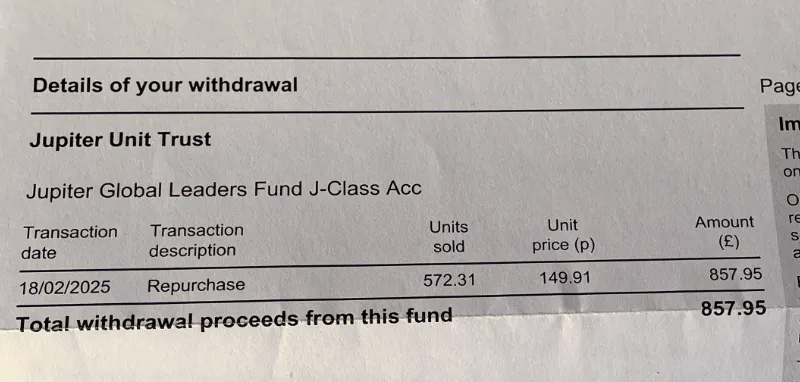

Just like a well-built site, dividend stocks reward you for the upfront effort. And let’s be honest, there’s something downright enticing about checking your trading account and seeing those dividends roll in, even if like for myself at the beginning of this journey, they are only smaller amounts.

Why Dividend Stocks Rock

So, why do I love dividend stocks so much?

- Passive Income That Feels Like Magic

Dividend stocks are the ultimate “set it and forget it” strategy. Once you’ve picked and invested in your stocks, those companies send you cash regularly — quarterly, monthly, or annually —without you doing a thing. It’s like your website getting clicks and ad revenue while you’re down the pub. - A Motivation Boost Like No Other

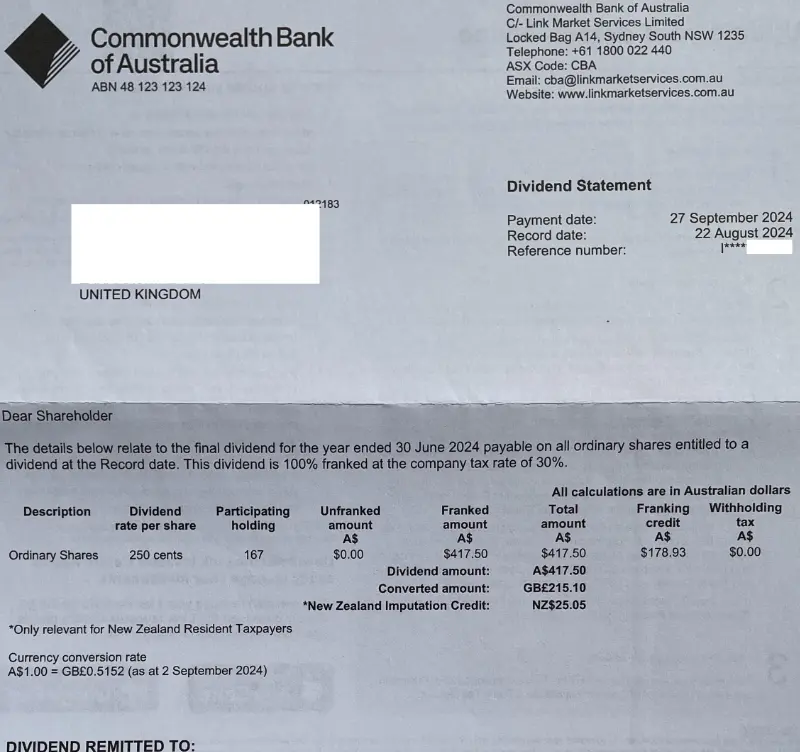

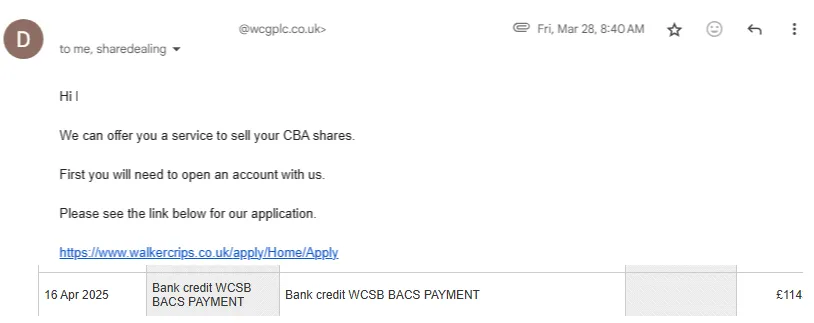

Every time a dividend hits my account, it’s like a little pat on the back from the universe saying, “Good job, Rob!” It’s motivating to see those payments stack up, encouraging me to keep investing and growing my portfolio. It’s the same rush as checking website analytics and seeing a spike in traffic — pure, unfiltered joy. - Stability in a Rollercoaster Market

The stock market can be a wild ride, but dividend-paying companies, especially blue-chip ones, are often stable giants like Unilever or BP. They’re less likely to tank during market wobbles, giving you peace of mind and steady payouts. It’s like having a website hosted on a rock-solid server — no crashes, just 100% uptime. - Compounding: The Snowball Effect

Reinvesting dividends is like adding fresh content to your website to grow traffic. Those dividends help buy more shares, which ultimately pay more dividends, and before you know it, your wealth is snowballing like a viral TikTok video. Compounding is the secret sauce that turns modest investments into a proper nest egg. - Inflation Protection

Many dividend stocks, especially from companies with a history of raising payouts, help you keep up with inflation. As their dividends grow, your income does too, unlike that dusty savings account earning under 1%. - Flexibility to Live Your Best Life

Dividend income gives you options. Use it to cover bills, fund a holiday, or reinvest back into stocks for more growth. It’s like the cash from your website letting you buy a new gadget or take a weekend getaway. - Low Maintenance, High Reward

Unlike running a business or managing rental properties, dividend stocks require minimal upkeep. Research your picks, invest, and let the companies do the heavy lifting. It’s like a website on autopilot — once it’s built, it just keeps humming along, sometimes with minimum interference. - A Sense of Ownership

Owning dividend stocks means you’re a shareholder in real businesses — think owning a tiny slice of Tesco or Shell. It’s empowering, like being the proud owner of a website you built from the ground up. Plus, you get to cheer for their success. - Tax Advantages

In the UK, we’ve got a dividend allowance (£500 in 2025, last I checked — double-check with HMRC, folks). Dividends within this limit are tax-free, and even beyond that, rates are often lower than income tax. It’s like getting a discount on your website hosting fees — every penny counts! And the best thing is if you put stocks in your Stocks and Shares ISA, they (and dividends) are free of tax and capital gains! - A Buffer Against Life’s Curveballs

Dividends provide a cash cushion for unexpected expenses, like a car repair or a surprise dentist bill. It’s like having a website that keeps earning even when life throws a tantrum, giving you one less thing to stress about.

Final Thoughts: Build Your Financial Website

Let’s be real — investing can seem like a soap opera sometimes, with market drama, tariffs and economic plot twists. But dividends? They’re like the friend who shows up with pizza and says, “Don’t worry mate, I’ve got you.” They’re predictable, reliable, and make you feel like you’re building for the future.

Investing in dividend stocks is like being a webmaster for your financial future. You put in the effort upfront — researching, investing, and maybe sweating over a few spreadsheets — but the payoff is a stream of passive income that keeps you motivated and moving toward your goals. Whether it’s the thrill of compounding, the stability of blue-chip payers, or the sheer joy of seeing dividends hit your account, there’s a lot to love.

So, grab a cup o’ tea and a slice of cake, start researching some UK dividend champs (maybe check out the FTSE 100’s stalwarts), and build your own “website” of wealth. Trust me, when those dividends start rolling in, you’ll be grinning like you just launched the next big thing. Happy investing!