I’m Rob and welcome to UK Dividends! If investing were a game, I’d be the bloke who knocks over the board before the dice even hit the table. A rookie investor, you say? Well, kind of – I did flirt a bit with the stock market before, but my first attempt was less of a “Hollywood success story” and more like a “comedy of errors.”

Let’s rewind to 1999. I’m a uni student, brimming with that invincible vibe only youth and a fresh £1000 prize cheque can bring. Most mates would’ve blown it on PlayStation games or a dodgy night out (probably both), but not me. I decided to be mature and try out some investing. Cue the montage: me squinting at financial pages, sipping instant coffee, and picking a Jupiter unit trust because—let’s be honest—it sounded fancy at the time, like something a proper adult would choose. So I chucked my grand in, leaned back, and pictured myself reaping the rewards. Oh, the optimism!

Reality, though? Brutal. Every year, I’d take a glance at the Jupiter statement and my £1000 was evaporating faster than sausage rolls at a buffet. At its lowest, it sank to around £400 — I’d turned a decent chunk of change into pocket lint. I loved watching films about success, Wall Street included, but this? This was more like watching paint peel, only the paint was my money. Jupiter must’ve taken pity on me because they shuffled me into another fund at some point, probably hoping I’d stop crying into my cheerios!

Here’s a nugget I wish I’d known then: investing’s a mixed bag. Some options are wild, like betting on a horse with three legs, while others — like dividend stocks — can be more like a trusty old hatchback: not sexy, but they should get you were you want to go…eventually. Back in ’99, I didn’t have a clue about that. I just had a cheque and a dream, and both got properly humbled.

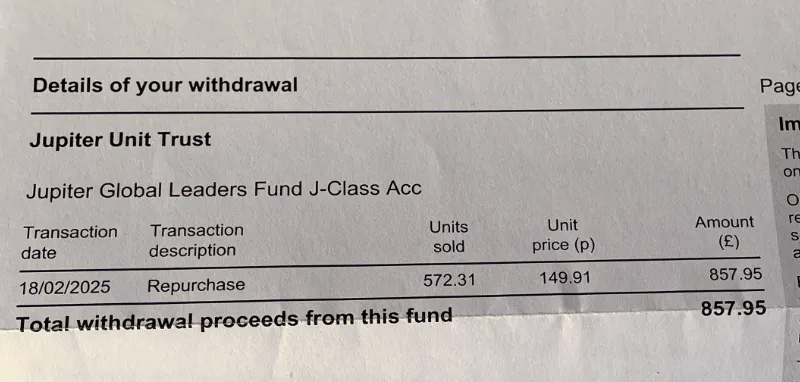

Fast forward to 2025. After 26 years of “time in the market” (that smug little phrase every finance guru loves), I cashed out.

The grand reveal? £857.95. A real kick in the teeth when you factor in inflation — £1000 in 1999 is worth around £2200 in today’s money. So, in genius fashion, I’d turned that grand into a spectacular loss. If there’s an award for “Most Creative Way to Shrink Money,” Rob’s your guy.

You’d reckon that’d scare me off investing for good, right? Shove the cash under the mattress and call it quits. Well, here’s the thing…this year, I was helping a friend untangle their finances, and they had 167 shares in the Commonwealth Bank of Australia they no longer wanted. They didn’t know how to sell them, so helped and tracked down Walker Crips. Two weeks later — bam — sold. £11,000+ in their account…I just had to remind them that next year they might be giving the tax man a couple of grand back in Capital Gains Tax!

The real jaw-dropper, though? They’d hoarded their dividend slips, and those shares had been quietly spitting out roughly £400 annually in the last few years. Every year. Like a loyal dog bringing you the paper, no questions asked. Meanwhile, my Jupiter fund was off misplacing my cash like I misplace my keys. That’s when it clicked: maybe investing doesn’t have to be a stomach-churning nightmare. Maybe dividends are my ticket…

Not sure what dividends are? They’re payouts companies give shareholders from their profits — like a “thank you” bonus. Imagine your shares winking at you every few months, slipping you a fiver for your troubles. They’re not the rockstar stocks that double overnight, but they’re the mate who shows up with pizza when you’re broke —reliable, understated, brilliant. Dividends can be a lifeline for folks.

But let’s talk risk, because investing’s never a sure thing. Even dividend stocks can wobble — think of them as a sturdy boat that still rocks in a storm. But compared to chasing the next Tesla (hello Palantir!), they feel less like gambling and more of a strategy. Plus, that regular payout? It’s a buffer when the market (or Trump) throws a tantrum. I’m not saying I’ve cracked the code — my track record’s more “cautionary tale” than “textbook” — but dividends seem like a saner bet for a guy like me who’s still finding his footing.

So here I am at 48 hopping back into the investing saddle — this time with dividend stocks (particularly UK ones) in my sights. I’m still a rookie but I’m taking it slow, one stock, one step, one slightly less terrible decision at a time. Cheers for joining me — let’s see where this wild ride takes us!

Leave a Reply