If you hold shares in the Commonwealth Bank of Australia, live in the UK and wish to sell them, this is my guide for how we did it.

Find a broker who can deal with shares on the Australian Stock Market. We found the investment company Walker Crips (no, not the crisp company!).

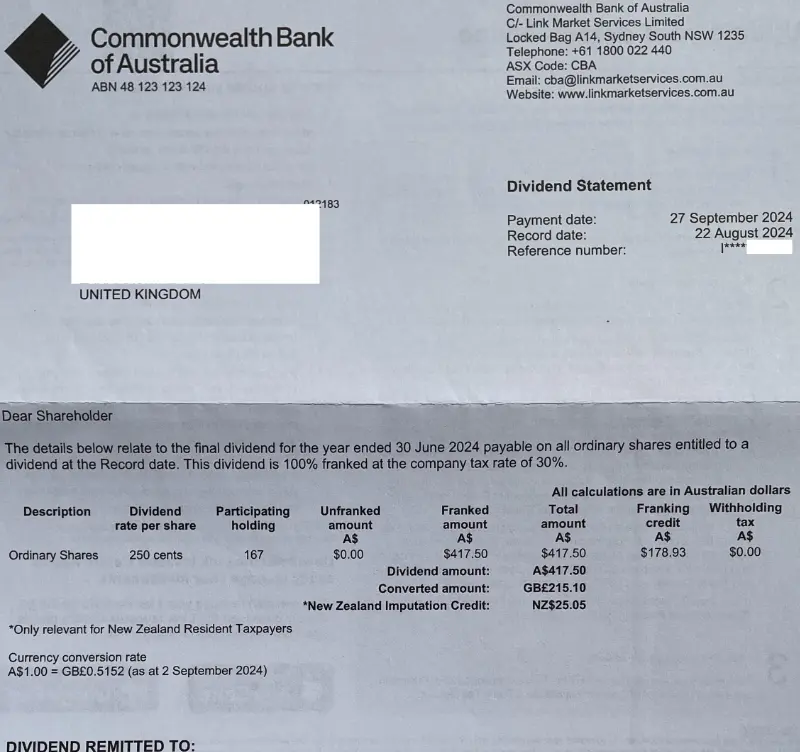

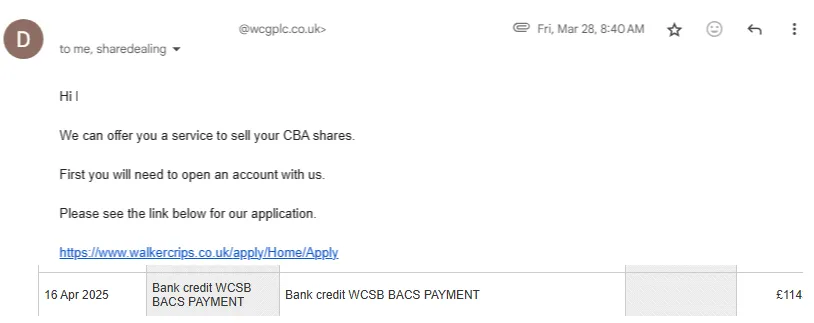

After contacting their customer service, one of the broker’s got back in touch with requirements. You need to find a dividend statement which has your SRN number on it. In recent years, CBA have blanked that number out in dividend statements, but if you’ve got one from 2020 or earlier it should be on there.

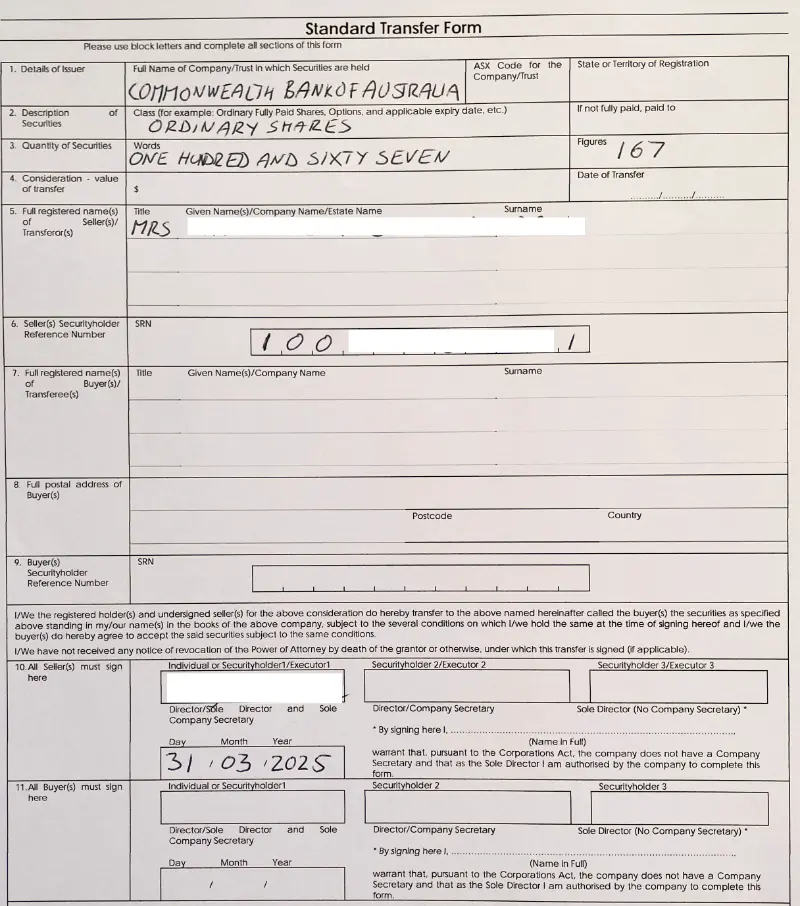

Next, you’ll need to fill in a Standard Transfer form, like the one Walker Crips send you below. Sign, date and take a photo of it.

Then send WalkerCrips a photo/scan of the form and your dividend statement with the SRN number on it. At this point, you’ll also need to open up a trading account with Walker Crips, so ensure you have a form of id like passport/driving license. The account opening goes through various financial and stock related questions, so take your time.

Once they’ve opened your account and verified your shares, they will then confirm you want to sell them and action it. In our case they also closed the account after transferring the money by BACS.

The costs involved were not as big as feared, only a bit over £100, , which when you consider the CBA shares themselves were worth more than £11000, that’s a non issue.

The dividend yield from Commonwealth Bank shares were solid through the years. 3-4% yields.

The whole process from initial contact to the money in the bank took less than 3 weeks. If you’ve been wondering about how to sell your Commonwealth Bank Shares in the UK, hopefully this guide will be of benefit. Just remember…you might still have to pay Capital Gains Tax on the gains!

Leave a Reply